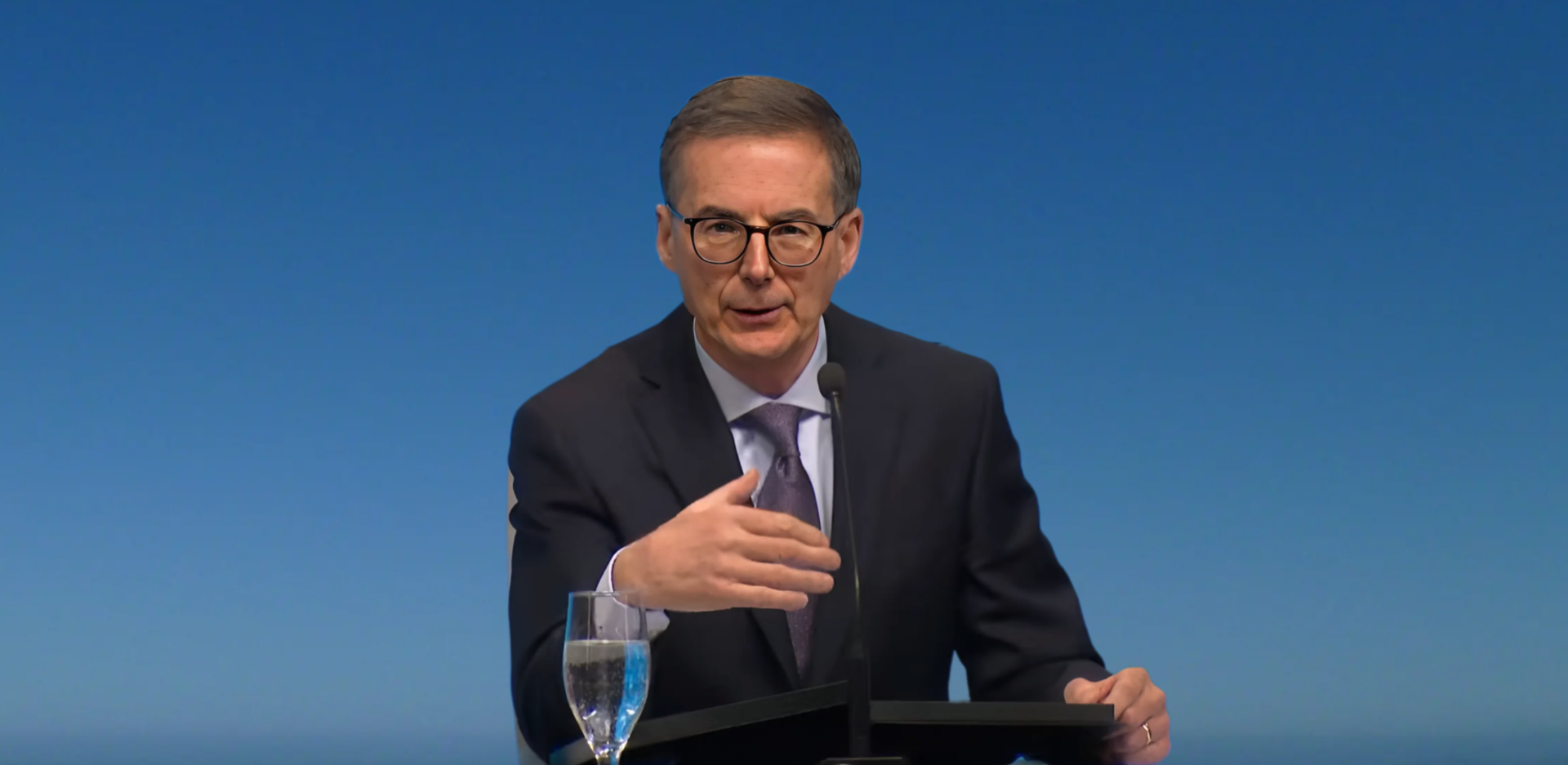

London, UK — Tiff Macklem, Governor of the Bank of Canada, delivered a significant address today at the Canada-UK Chamber of Commerce, shedding light on the evolving global trade landscape and its implications for Canada.

Macklem outlined how recent geopolitical and economic disruptions are reshaping global trade patterns. He highlighted that events such as the COVID-19 pandemic, Russia’s invasion of Ukraine, and ongoing inflationary pressures have dramatically altered the global economic environment. Reflecting on the past, Macklem noted a stark contrast from the issues his predecessor addressed in 2018, emphasizing the current era’s heightened complexity.

Macklem discussed several key trends reshaping global trade:

Slowdown in Advanced Economies: Trade growth in developed nations has slowed considerably over the past decade, with emerging and developing economies experiencing a surge in trade activities.

Shift to Services: Despite stagnation in goods trade, services trade has been growing. The pandemic accelerated this trend, boosting demand for digital and high-value services.

Fragmentation and Realignment: Geopolitical tensions are causing realignments in trade routes and supply chains, notably affecting China’s role as a global manufacturing hub.

For Canada, these shifts present both challenges and opportunities. Macklem emphasized the importance of leveraging Canada’s historical trade relationships while adapting to new opportunities. He underscored the significance of Canada’s trade with the United States and the growth in service exports, particularly in technology and financial services.

Macklem also acknowledged the risks associated with global trade fragmentation, highlighting the need for Canada to be agile and strategic in its trade policies to navigate these challenges effectively.

In the follow-up question and answer session, Macklem addressed how the Bank of Canada is managing inflation amid the global trade disruptions. He explained that the bank is enhancing its data analysis and scenario modeling to better understand and respond to supply chain issues. “We’re investing in data and analysis to better understand supply chains, especially at the global level,” Macklem stated.

He also discussed the challenge of balancing inflation and economic growth. “Supply shocks present central banks with a difficult trade-off,” he said, highlighting the Bank’s focus on risk management to balance inflationary pressures against economic growth.

Looking ahead, Macklem indicated that further interest rate adjustments may be necessary depending on evolving economic conditions. He noted potential risks such as high shelter price inflation and wage growth exceeding productivity gains. “We are not on a predetermined path,” Macklem emphasized. “We will take decisions based on the best available information at the time.”

The evolving global trade landscape and persistent inflationary pressures present both challenges and opportunities. As Canada navigates this complex environment, the central bank’s strategic approach will continue to evolve in response to new information and shifting economic conditions. Only time will reveal how these factors will ultimately shape Canada’s economic future, but Macklem’s insights offer a roadmap for navigating the uncertainties ahead.