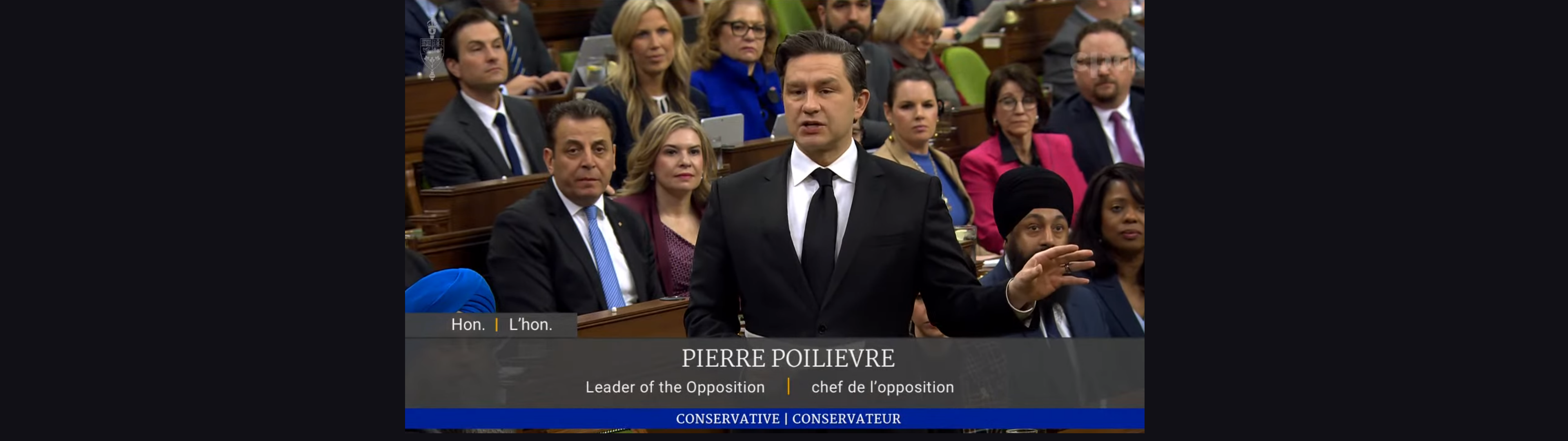

In a fiery exchange today in the Canadian House of Commons, the debate over the effectiveness and implications of the carbon tax escalated as Conservative Leader of the Opposition, Pierre Poilievre, presented a barrage of arguments against the government’s carbon pricing policy, leaving the Liberal Party struggling to provide a compelling response.

Poilievre voiced concerns about the financial strain experienced by Canadian families due to the carbon tax. He pointed to a report by the parliamentary budget officer, which indicated that the average Nova Scotia family faces a staggering $1,500 burden due to the carbon tax. He urged the Prime Minister to grant his caucus a free vote on the Conservative motion to halt the tax increase, emphasizing the bipartisan opposition from Nova Scotia’s legislature.

In response, Prime Minister Justin Trudeau defended the carbon pricing policy, asserting that 8 out of 10 families across Canada receive more money from the carbon rebate than they pay into it. Trudeau emphasized the importance of combating climate change while supporting Canadian families with financial assistance for groceries, rent, and other expenses impacted by environmental factors.

However, Poilievre continued to press the Prime Minister, challenging the discrepancy between the cost burden and the rebate amounts provided to Canadian families. He cited figures from the parliamentary budget officer, claiming that the rebate falls short of covering the actual costs incurred by families in provinces like Nova Scotia and Ontario.

The debate further intensified when Poilievre expanded his critique to include other provinces, such as Ontario and British Columbia. He highlighted that, according to reports, the average Ontario family faces a cost of $1,674 due to the carbon tax, while the rebate amounts to only $1,047, leaving Ontarians with a net loss. Similarly, in British Columbia, where the NDP government oversees the carbon tax, scrutiny arose over budgetary projections. Reports suggested a stark contrast between the projected revenue of $9 billion over three years and the allocated $3 billion for rebates, resulting in a nearly $6 billion net cost to taxpayers.

Trudeau countered Poilievre’s arguments by accusing him of disregarding facts and evidence, asserting that the carbon pricing policies are essential for reducing carbon emissions and building a cleaner economy for future generations. He emphasized that the carbon rebate program aims to alleviate financial burdens on Canadian families while simultaneously addressing the urgent need to combat climate change.

The battle over the carbon tax is far from over, and its outcome will have profound implications for Canadian families and the environment.