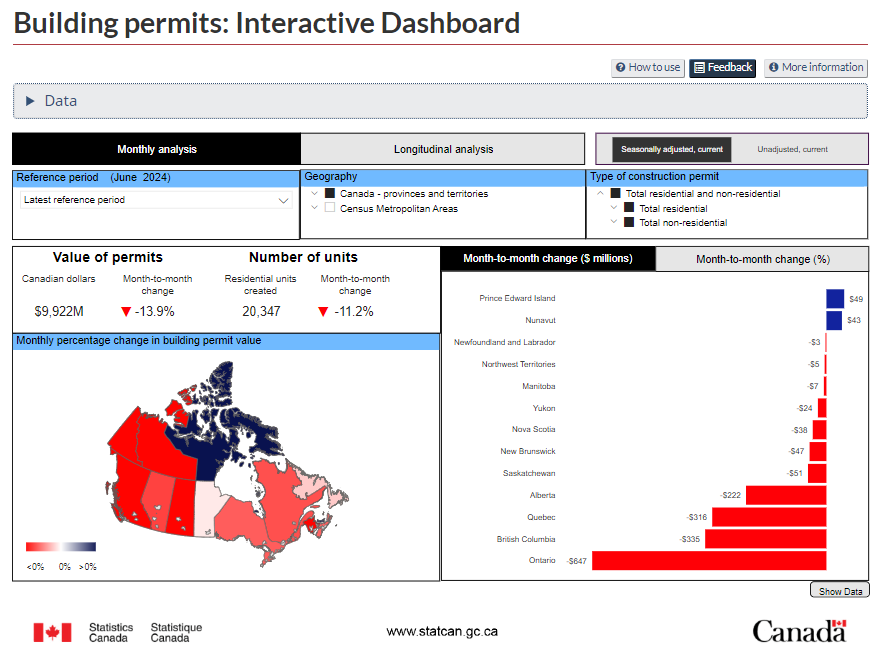

The total value of building permits across Canada saw a notable decline of 13.9% in June 2024, dropping to $9.9 billion according to the latest data released by Statistics Canada. This marks the second consecutive month of decline, following a similar trend in May. The downturn in building permits is evident across both residential and non-residential sectors, affecting nearly all provinces and territories.

The residential sector, which traditionally drives much of the building activity in Canada, experienced a notable contraction. The total value of residential building permits fell by 11.5% to $6.5 billion in June. A deeper look into the figures reveals a sharp drop in multi-unit construction intentions, which plunged by 19.8%, a decrease of $937.1 million. This sector’s downturn was significantly impacted by Ontario and British Columbia, with Ontario seeing its most substantial monthly drop since December 2023.

Despite the overall decline, there was a glimmer of growth in the single-family home segment. Permits for single-family dwellings rose by 4.0%, reaching $2.6 billion. This uptick suggests that while broader residential construction activity may be slowing, demand for single-family homes remains resilient.

In total, Canadian municipalities authorized the construction of 20,400 dwelling units in June, contributing to a 12-month total of 263,400 units since July 2023. This steady stream of authorizations indicates continued interest in residential development, albeit with fluctuations between different types of housing.

The non-residential sector experienced an even steeper decline than the residential sector, with the total value of permits dropping by 18.1% to $3.5 billion in June. The industrial component was particularly hard hit, seeing a dramatic 42.6% decrease, following a notable increase in May. This suggests a volatile industrial market, where intentions for new projects can swing significantly from month to month.

Commercial construction intentions also saw a decline, falling by 15.6%, a decrease of $331.1 million. However, the institutional component managed a slight increase of 1.0%, reflecting continued investment in public buildings and infrastructure.

Despite the month-to-month fluctuations, the second quarter of 2024 ended on a somewhat positive note. The total value of building permits rose by 2.1% from the first quarter, reaching $34.6 billion. This marks the second consecutive quarterly increase and the fourth highest quarterly value on record.

The residential sector was the main driver of this growth, with permits increasing by 6.9% to $22.2 billion in the second quarter. Ontario played a pivotal role in this growth, particularly through its multi-unit construction segment, which surged by 35.0%, a gain of $1.6 billion. This led to a national record of $14.4 billion in multi-unit residential permits for the quarter.

However, it’s essential to note that this growth was not uniform across Canada. Excluding the Toronto area, the total value of multi-unit residential building permits actually declined by 2.2% in the second quarter, highlighting regional disparities in construction activity.

While the residential sector saw gains, the non-residential sector did not share the same positive trajectory in the second quarter. The total value of non-residential building permits declined by 5.6%, with decreases across all three components: industrial, commercial, and institutional. The industrial sector, in particular, saw the most significant decline, dropping by 14.8%, a decrease of $437.5 million.

The data from June 2024 paints a complex picture of Canada’s construction industry. While the overall value of building permits is down, particularly in the non-residential sector, there are pockets of growth, especially in the single-family and multi-unit residential segments. The second quarter’s record high in multi-unit residential permits, driven largely by Ontario, underscores the continued demand for housing, even as other sectors struggle.